Postbaccalaureate Premedical Program

The Postbaccalaureate Premedical Program (PPP) represents a significant investment of both your time and financial resources. This page includes information about the cost of the program, your options for financing your course of study and the steps you should follow to obtain funding.

Cost of the Program

The PPP core includes nine classes, and each class is worth 4 units of credit. Postbaccalaureate students generally enroll in two classes each semester.

Estimated Tuition Cost

Students pay tuition one semester at a time and are charged on a per-unit basis. Please note that tuition rates are subject to change every academic year. The "program tuition" estimate below is for financial planning purposes only and is a rough estimate based on 2021-2022 rates. It does not reflect a true projection of future program tuition costs. Please visit classes.usc.edu for the most current per-unit tuition rate.

Estimated Tuition (based on 2021-2022 per-unit costs)

- Per-class tuition ($2,035 x 4 units): $8,140

- Program tuition cost for nine core classes ($2,035 x 36 units): $73,260

Other Expenses

Besides tuition, students should budget for required fees and books each semester. USC also accounts for living and personal expenses in the budget for this program. Students may choose to borrow loans to pay for these additional costs. The following chart is based on estimates for the 2021-2022 academic year, which are subject to change.

| EXPENSE | FALL | SPRING | SUMMER |

| Tuition based on 8 units | $16,280 | $16,280 | $16,280 |

| Mandatory USC fees | $505 | $505 | $301 |

| USC health insurance (if not waived) | $753 | $1,363 | $0 |

| Books and supplies (based on eight units of coursework) |

$300 | $300 | $300 |

| Living costs

(includes housing and dining, transportation, and personal expenses) |

$12,128 | $12,128 | $8,085 |

| TOTAL | $29,966 | $30,576 | $24,966 |

Financing Options

USC Payment Plan

USC offers the interest-free USC Payment Plan, which allows you to divide each semester’s charges into five monthly payments. For more information, please visit the Student Financial Services website.

Direct Subsidized and Unsubsidized Loans

PPP students are eligible to apply for Direct Subsidized and Unsubsidized Loans for the first 12 consecutive months of the program, which includes a fall, spring and summer semester (or spring, summer and fall for students first admitted to spring semester), as long as they are enrolled in two classes (or take at least 6 units) each semester.

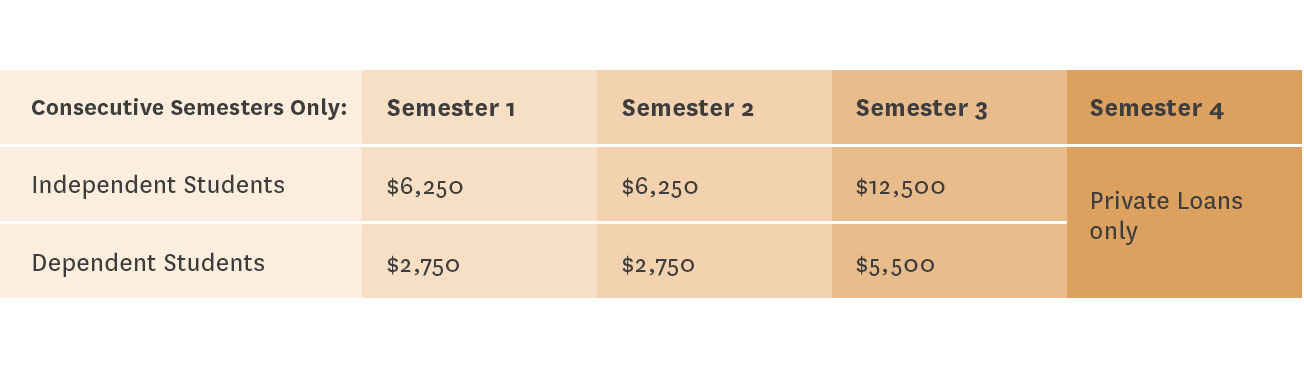

A PPP student’s annual borrowing limits for Direct Subsidized and Unsubsidized loans are based upon dependency status. A student is considered independent if they were born after January 1, 1998; are married; have a dependent; or are a veteran.

Independent students may borrow up to $25,000 annually in Direct Subsidized and Unsubsidized Loans. Dependent students may borrow up to $11,000 annually in Direct Subsidized and Unsubsidized Loans. Please note that these amounts are split unevenly; see distributions below.

For more information about the Direct Loan program, please visit our Direct Loan page or studentaid.gov.

Direct Parent PLUS Loans

Parents of independent students are not eligible for the Direct Parent PLUS Loan.

Parents of dependent students may apply for the Direct Parent PLUS Loan to cover remaining costs and living expenses for the first 12 consecutive months of their student's program, as long as the student is enrolled in two classes each semester (or takes at least 6 units each semester). For more information about the Direct PLUS Loan program, please visit our Federal Direct Parent PLUS Loan page or studentaid.gov.

Direct Graduate PLUS Loans

PPP students are not eligible for the Graduate PLUS Loan under any circumstances.

Private Loans

For both years of the program, students may apply for private loans to cover remaining costs and living expenses. These loans may require in-school interest payments. To qualify, students must have good credit and are strongly encouraged to apply with a credit-worthy co-borrower. Pre-approval before you start the program is highly recommended if you plan to utilize private loans as a funding source.

Please note that most private lenders have aggregate loan limits. Applying for these loans before your program starts will help ensure this as possible funding source.

For more information and a link to the ELM Select lender tool, please visit our Private Financing page.

Disbursement of Loans

Students must meet all eligibility requirements and be enrolled in at least two classes (or a minimum of 6 units) to receive federal loan funds. Federal and private loan funds are first applied to your student fee bill. The remainder is then credited to your bank account, provided you have registered for EFT Direct Deposit. To register for direct deposit of refunds, visit the Student Financial Services website.

Applying for Aid

First-Year PPP Students

First-year PPP students should complete the steps detailed for new undergraduate students. Please note, however, the following differences specific to the PPP program:

FAFSA

On the FAFSA, indicate that you are a fifth-year undergraduate. For your educational goals, select "undeclared/undecided".

PPP students do not need to fill out the CSS Profile application. They are also not required to submit federal tax return information.

Financial Aid Supplement

Log in to your page and complete the in the Document Library.

Select the “Postbaccalaureate Premedical” program, then confirm the number of units you will be enrolled in and your housing status for your intended semesters.

Please submit this form each time your enrollment or housing plans change. Outdated or otherwise inaccurate information may prevent your financial aid from being disbursed.

Grants

PPP students are not eligible to apply for grants.

Direct Subsidized and Unsubsidized Loans

For independent and dependent students:

Students will need to fill out the Direct Loan Request Form, which can be found in the Document Library of your page.

Direct Parent PLUS Loans

For parents of dependent students only:

Parents who wish to be considered for the Parent Plus Loan should visit studentaid.gov and select “Apply for a Parent PLUS Loan” under the “Apply for Aid” tab.

Private Loans

For independent and dependent students:

Students pursuing private educational loans should obtain pre-approval from their lender of choice. Please refer to our Private Financing page for information about how to apply.

Continuing PPP Students

After the first 12 consecutive months of the program (three consecutive USC semesters), PPP students are ineligible for Direct Subsidized and Unsubsidized Loans but may be eligible for private loans.

The three consecutive USC semesters limit starts in your first semester and continues even if you skip one semester, take a leave of absence or enroll less than half time. For example, if you start the PPP program in the fall semester, then take one class (which is considered less than half time) in the spring, the spring semester still counts as your second semester even though you did not receive Direct Loans for that term. The same federal regulation applies if you take a leave of absence.