Direct Loan

Direct Loans are available to most eligible borrowers who apply for financial aid.

Qualification and How To Apply

To be eligible for the Direct Loan, you must:

Be enrolled at least half-time;

Be enrolled in the number of units indicated in your Financial Aid Summary; and

Maintain Satisfactory Academic Progress (SAP) toward your degree objective.

Read more about the SAP Policy for Undergraduates or Graduates.

How to Apply

To receive a Direct Loan, you must first apply for financial aid online at fafsa.gov. If you have not yet applied, do so as soon as possible, even if the priority date has already passed.

If you have applied for financial aid, and your Financial Aid Summary includes the Direct Loan, please click on Receiving Your Funds, and follow the instructions.

Receiving Your Funds

Complete ALL four steps to obtain your Direct Loan:

Step 1. Log in to your page and complete the Direct Loan Request form found in the Document Library.

Undergraduate students must wait to receive their Financial Aid Summary before they submit the form. Graduate students may complete the form at any time. Once the Financial Aid Office processes your loan and notifies the Department of Education, we will e-mail you confirmation. You can check your financial aid status at any time by logging in to .

Step 2. Sign your Master Promissory Note (MPN) online at studentaid.gov.

You will need the FSA ID issued to you by the Department of Education when you completed your FAFSA. If you have forgotten your FSA ID, you can retrieve it through studentaid.gov. You will be able to sign your MPN after the Financial Aid Office processes your loan and notifies the Department of Education of your eligibility. You can check the status of your MPN by logging in to .

You will not be required to complete a new MPN if you previously borrowed a Direct Loan at another school, and your existing MPN is not more than 10 years old.

Step 3. You must complete entrance loan counseling online at usc.igrad.com if you are:

A first-time undergraduate or graduate borrower at USC; or

A new graduate student who borrowed at USC as an undergraduate student.

Step 4. First-time undergraduate borrowers must attend an in-person entrance loan counseling session.

For a schedule of sessions, please refer to the Loan Counseling page.

Step 5. All borrowers must complete an Annual Student Loan Acknowledgement on studentaid.gov.

Annual Student Loan Acknowledgement:

In order for your loans to disburse for the academic year, all borrowers must complete an Annual Student Loan Acknowledgment at studentaid.gov (studentaid.gov/asla). The purpose of this acknowledgement is to help you understand how your loans affect your financial future. Borrowers accepting a subsidized/unsubsidized loan, a PLUS loan for graduate/professional students, or a PLUS loan for parents must complete this acknowledgement.

Loan Disbursements and Fees

USC generally creates one loan per each enrolled semester. If you are enrolled and otherwise eligible, your loans will be disbursed no sooner than 10-days before the start of each semester.

Potential Delay of Disbursements Due to Monitoring of Satisfactory Academic Progress

For continuing students, financial aid may not be disbursed to a student’s account until SAP has been evaluated. The Financial Aid Office cannot complete the SAP evaluation until prior semester grades have been officially posted by the Office of Academic Records and Registrar. An otherwise eligible student may experience a delayed financial aid disbursement if grades are not made official before the beginning of the subsequent semester. No exceptions can be made to this process.

Read more about the SAP Policy for Undergraduates or Graduates.

Federal Origination Fees will be deducted from each disbursement:

1.057 percent for all loans made on or after October 1, 2021 and before October 1, 2022.

1.057 percent for all loans made on or after October 1, 2020 and before October 1, 2021.

Interest Rates and Subsidized vs. Unsubsidized Direct Loans

Rates are fixed depending on the student's enrollment status, the type of loan and the date of first disbursement.

Undergraduate Subsidized Direct Loans:

First disbursed July 1, 2021 - June 30, 2022 - 3.73 percent

First disbursed July 1, 2020 - June 30, 2021 - 2.75 percent.

Undergraduate Unsubsidized Direct Loans:

First disbursed July 1, 2021 - June 30, 2022 - 3.73 percent.

First disbursed July 1, 2020 - June 30, 2021 - 2.75 percent.

Graduate Unsubsidized Direct Loans:

First disbursed July 1, 2021 - June 30, 2022 - 5.28 percent.

First disbursed July 1, 2020 - June 30, 2021 - 4.30 percent.

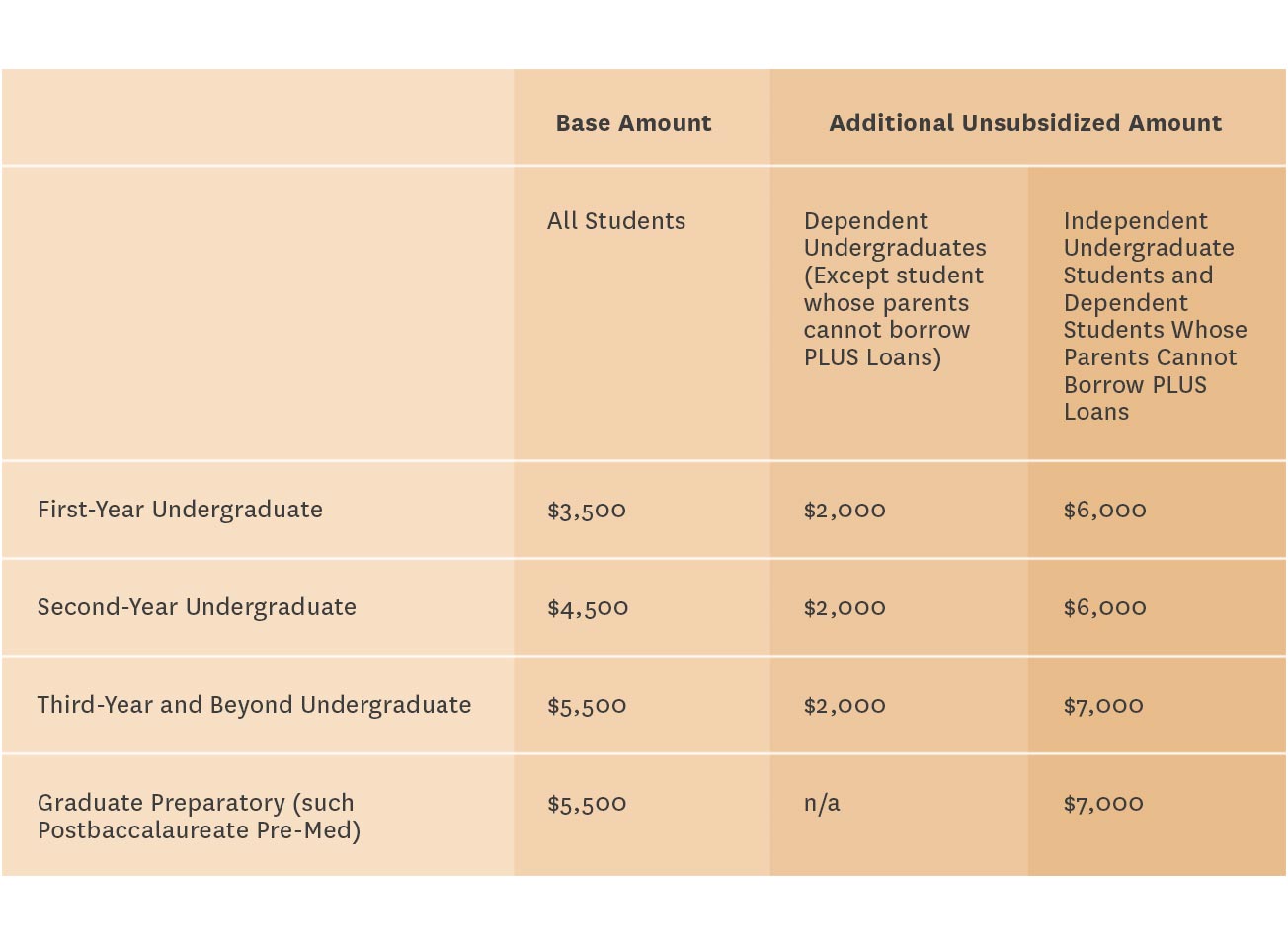

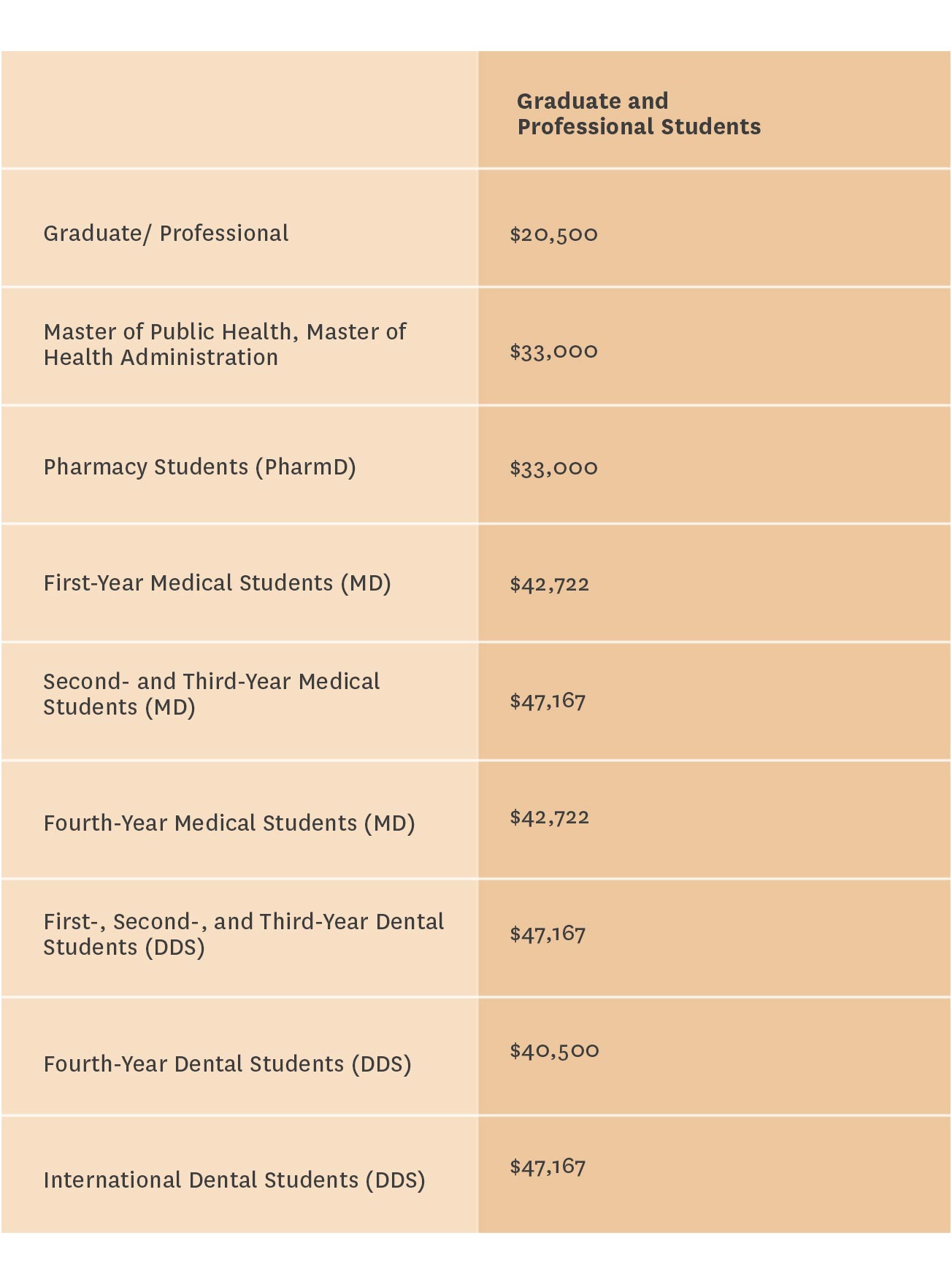

Annual Loan Limits for Direct Loans

The amounts students may borrow annually are based on program of study, academic level and federal dependency status. Please note that Subsidized Loans are limited by your financial need. Unsubsidized Loans are limited by your Cost of Attendance, less other aid received.

Most USC programs use an academic calendar that consists of two terms. Eligible students in these programs regain annual loan limit eligibility after successfully completing two academic terms.

Certain graduate and professional programs of study use an academic calendar that consists of three terms. Eligible students in those programs regain eligibility for a new annual loan limit after three successfully completed terms. These programs include but are not limited to the Master of Arts in Teaching (MAT), Executive MBA (EMBA), Doctor of Medicine (MD), and Doctor of Dental Science (DDS).

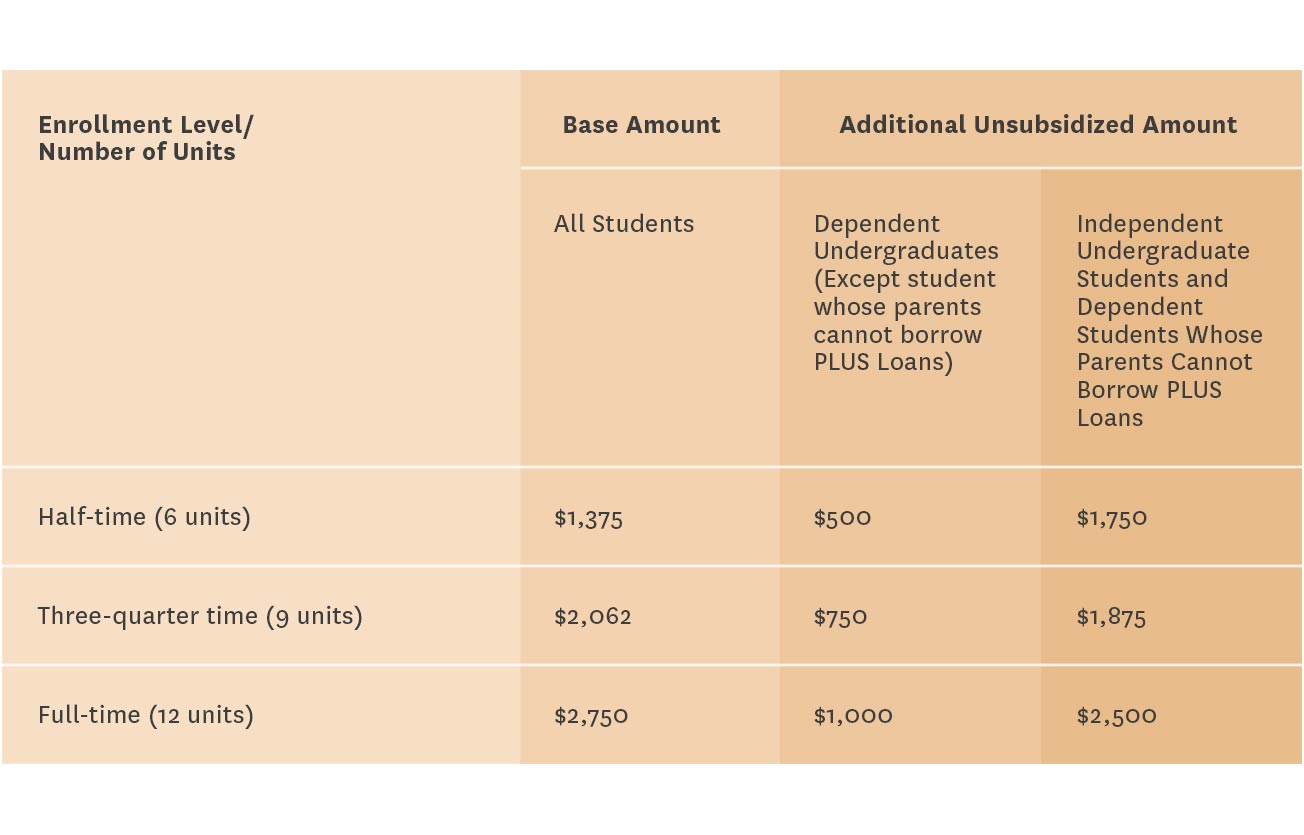

Graduating Seniors Attending One Semester

If you have plans to graduate after attending a single semester this academic year, you will be eligible for only prorated amounts of Subsidized and Unsubsidized Loans. The prorated amounts are based on the number of units you will attempt in your final semester.

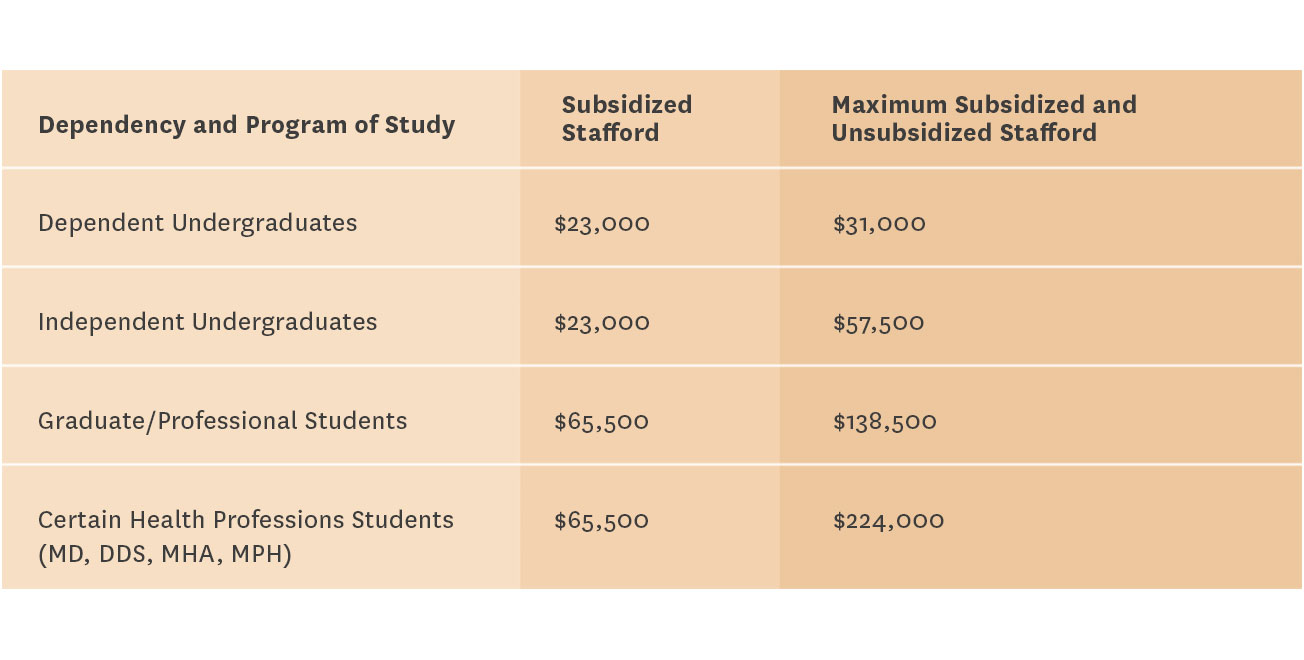

Aggregate Loan Limits for Direct Loans

The figures in the table below represent the total loan amounts students may borrow for their entire academic careers, based on academic level and federal dependency status.